Amur Capital Management Corporation Fundamentals Explained

Amur Capital Management Corporation Fundamentals Explained

Blog Article

Some Known Details About Amur Capital Management Corporation

Table of ContentsAmur Capital Management Corporation for DummiesEverything about Amur Capital Management CorporationAmur Capital Management Corporation - An OverviewGetting My Amur Capital Management Corporation To WorkOur Amur Capital Management Corporation StatementsSome Known Questions About Amur Capital Management Corporation.

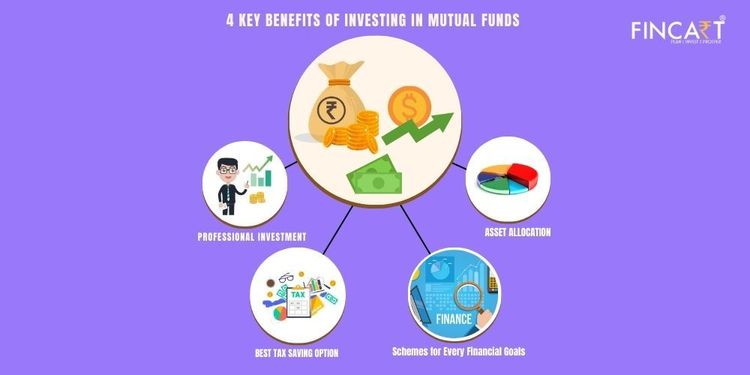

Foreign direct investment (FDI) takes place when a specific or company has a minimum of 10% of a foreign firm. When capitalists have less than 10%, the International Monetary Fund (IMF) defines it merely as part of a supply profile. Whereas a 10% ownership in a business does not give a specific investor a controlling passion in an international company, it does permit influence over the company's management, operations, and overall plans.Companies in creating countries require multinational financing and proficiency to increase, offer structure, and guide their global sales. These international business need personal financial investments in framework, energy, and water in order to increase jobs and incomes (passive income). There are different levels of FDI which range based on the kind of companies involved and the reasons for the investments

Examine This Report about Amur Capital Management Corporation

Other kinds of FDI include the purchase of shares in a connected venture, the incorporation of a wholly-owned business, and involvement in an equity joint venture throughout international borders (https://hearthis.at/christopher-baker/set/amur-capital-management-corporation/). Financiers who are preparing to take part in any sort of FDI could be smart to consider the financial investment's benefits and negative aspects

FDI improves the manufacturing and solutions sector which results in the production of jobs and helps to lower joblessness prices in the nation. Enhanced work translates to greater earnings and outfits the population with even more buying powers, boosting the general economic climate of a country. Human resources entailed the expertise and capability of a labor force.

The creation of 100% export oriented units help to aid FDI investors in improving exports from other countries. The circulation of FDI right into a nation translates into a continuous circulation of international exchange, helping a nation's Reserve bank keep a prosperous get of forex which leads to steady exchange rates.

Our Amur Capital Management Corporation PDFs

International straight investments can often impact exchange prices to the advantage of one country and the detriment of one more. When capitalists invest in foreign counties, they may observe that it is a lot more costly than when items are exported.

Considering that foreign direct financial investments might be capital-intensive from the factor of view of the financier, it can occasionally be really risky or economically non-viable. Many third-world countries, or at least those with background of company website colonialism, worry that foreign direct investment would result in some kind of contemporary financial colonialism, which reveals host nations and leave them at risk to international business' exploitation.

Stopping the accomplishment gap, enhancing health and wellness results, improving revenues and giving a high price of financial returnthis one-page paper summarizes the benefits of spending in high quality early childhood education for disadvantaged children. This document is commonly shown policymakers, advocates and the media to make the case for very early youth education.

Getting The Amur Capital Management Corporation To Work

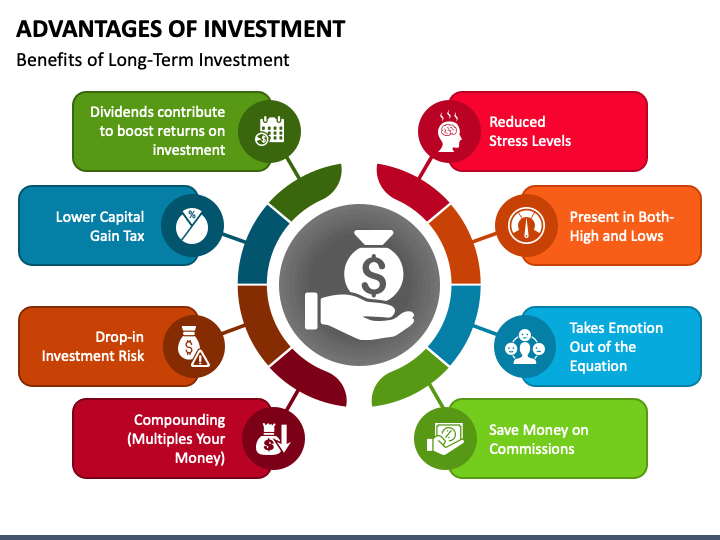

Take into consideration exactly how gold will certainly fit your financial goals and long-term financial investment strategy before you invest - accredited investor. Getty Images Gold is commonly considered a strong asset for and as a in times of uncertainty. The rare-earth element can be appealing through durations of economic uncertainty and recession, in addition to when rising cost of living runs high

How Amur Capital Management Corporation can Save You Time, Stress, and Money.

"The perfect time to develop and assign a model portfolio would be in less unpredictable and demanding times when feelings aren't controlling decision-making," says Gary Watts, vice head of state and financial advisor at Wealth Improvement Team. Besides, "Sailors outfit and provision their watercrafts prior to the storm."One means to identify if gold is appropriate for you is by researching its advantages and disadvantages as an investment selection.

So, if you have cash money, you're efficiently shedding money. Gold, on the other hand, may. Not everyone agrees and gold might not always climb when rising cost of living goes up, however it can still be an investment factor.: Getting gold can potentially assist capitalists get with unpredictable economic problems, considering the throughout these durations.

Excitement About Amur Capital Management Corporation

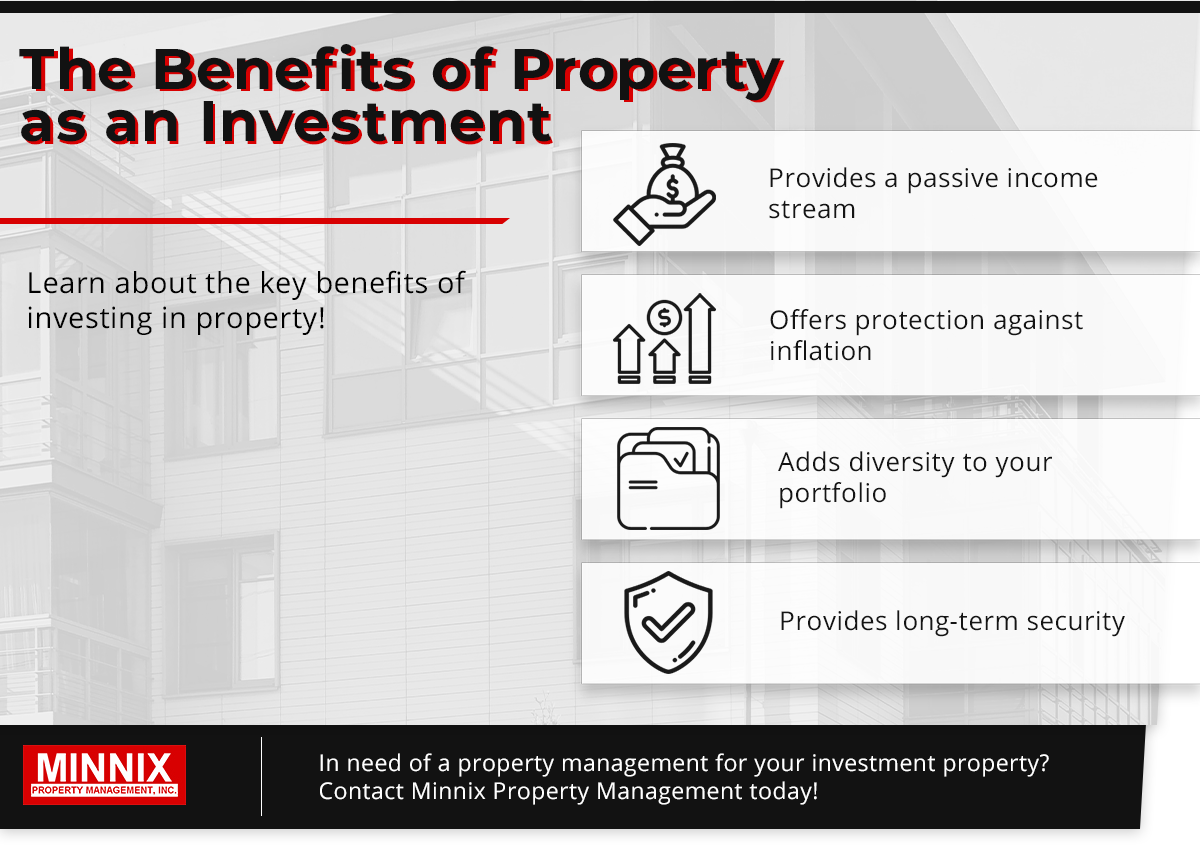

That doesn't imply gold will always go up when the economic climate looks unsteady, yet maybe great for those who plan ahead.: Some capitalists as a means to. Instead of having all of your money locked up in one asset course, different can possibly help you much better take care of threat and return.

If these are some of the advantages you're seeking after that start buying gold today. While gold can aid add equilibrium and protection for some financiers, like many financial investments, there are additionally runs the risk of to keep an eye out for. Gold could surpass other properties during details durations, while not standing up also to lasting cost recognition.

Report this page